‘Out-of-control’ week for VLCCs ends with new record WS 400 fixture

‘Out-of-control’ week for VLCCs ends with new record WS 400 fixture

Extraordinary gains continue to be recorded on main VLCC routes as the positive effects spill over to other tanker segments

Spot rates of VLCCs rose further on main trading routes across the globe on Friday, with one of the fixtures reported at an extraordinary level of Worldscale 400.

Tankers International data showed Reliance Industries tentatively fixed the 306,200-dwt Princess Mary (built 2004) for a voyage charter from the Middle East Gulf (MEG) to the west coast of India at this rate, with a loading date between 2 and 4 April.

Calculated on a time charter equivalent basis excluding idle days, earnings from the deal for vessel operator Hellenic Tankers would reach a whopping $411,890 per day in a round voyage, the highest in recent memory.

Continuing its recent chartering spree, Bahri put another VLCC on subjects for the MEG-US Gulf voyage at WS 202.5, according to Tankers International.

The 297,100-dwt Sea Splendor (built 2012) will be loading its cargo between 2 and 6 April.

Separately, TradeWinds understood Day Harvest fixed one of DHT Holdings’ scrubber-fitted VLCCs to lift from the MEG between 5 and 7 April for a voyage to China.

The 298,600-dwt DHT Lake (built 2004) was put on subjects for WS 215.

Earlier this week, spot fixtures for the MEG-west coast of India trade were done at WS 72.5, MEG-US Gulf at WS 170 and MEG-China at WS 155, respectively.

Reliance, Hellenic and Bahri did not immediately reply to emails seeking comment.

Fixtures firmed up

The latest rally has come as most of the tentative fixtures fixed at strong levels on Tuesday and Wednesday were concluded, boosting market confidence the VLCC bull runs will continue for some time.

“We’ve lifted the subjects on all the deals we put on subjects so far,” said a major tanker broker based on London.

With the recent spike in freight rates, Bloomberg reported Unipec, the trading arm of Chinese oil major Sinopec, could cancel four to eight VLCC fixtures in the MEG next month.

However, Clarksons Platou Securities suggested the news can be overlooked.

“We would note that Unipec and other Chinese charterers have not really been in the market of late and hence we don’t think this is material,” the brokerage said.

“Fundamentally, the current spike in rates is driven by a surge in Saudi oil production and hence can be seen as an oil supply push, which we argue would happen almost irrespective of what refining demand is in the short term.”

After Saudi Arabia fired the first shot in an all-out price war among crude producers last weekend, tanker earnings have been rising rapidly with floating storage requirements and rising Middle Eastern crude exports.

Bullish across the spectrum

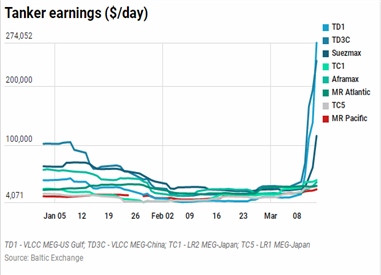

The strongest gains were observed on the MEG-USG route, where VLCC TCE earnings were assessed by the Baltic Exchange at $274,052 per day on Friday, compared with the day-ago level of $139,138 and the day-ago level of $12,289.

Boosting the earnings was the chartering spree by Bahri, the Saudi state carrier that fixed more than a handful VLCCs for this trade so Saudi Aramco can expand its market share in the US, according to analysts.

On the MEG-China route, VLCC earnings were assessed at $243,347 per day on Friday, compared with $194,297 on Thursday and $30,339 a week ago.

“While it seems out of control…I don’t think the rate momentum will be slowing anytime soon,” a broker said. “Oil is very cheap, and refineries can buy more as they are enjoying good margins.”

Despite the Unipec cutback news, Chinese consultancy CHEM99.COM said teapot refineries in Shandong are expected to raise their crude runs significantly later this month with recovering gasoline and diesel demand in China.

The bullish effects have spilled over to other tanker segments, with cheap oil prompting cargo movements despite low consumption amid the coronavirus pandemic.

Average suezmax earnings jumped to $116,357 per day from the week-ago level of $24,468, while average aframax earnings increased to $38,062 per day from $18,577.

As for product tankers, LR2 earnings on the MEG-Japan route were up 55.2% week-on-week at $41,548 per day, while LR1 up 67% at $31,161 per day.

The MR Pacific rate rose to $25,584 per day from $19,309 a week ago, and Atlantic rate improved slightly to $31,913 per day from $30,297.

Today's Bunker Prices: