Scrubber payback pushed out to four years as spread narrows again

Scrubber payback pushed out to four years as spread narrows again

Clarksons Platou Securities says difference between high and low sulphur fuel now only $75

A further narrowing of the spread between high and low sulphur bunkers means shipowners could take up to four years to pay back their scrubber retrofit costs.

The price of ship fuel has been dropping as a result of lower crude prices, although high-sulphur fuel oil (HSFO) has been more resilient than low-sulphur fuel oil (LSFO), Clarksons Platou Securities said.

Over the past week, HSFO prices on a global basis have declined by $23 per tonne to $200, while LSFO fell $50 to $275.

Spreads have been below $100 this month, and currently stand at $75 per tonne, the lowest level seen since at least 2017, Clarksons Platou said.

Analysts led by Frode Morkedal said the narrowing is "clearly" keeping any thoughts of a second wave of scrubber installations at bay, though there remains a meaningful gain to be captured for retrofitted ships.

Scrubber-fitted VLCCs are able to realise a $4,000 per day benefit, while capesize bulkers are seeing a $2,500 per day benefit at Monday’s prices.

"While not as attractive as before, and with a payback on investment of closer to three to four years, scrubbers continue to provide some benefit," the analysts added.

Better for bulkers?

"It may not be as visible in the tanker sector, where owners are seeing extremely high rates, but in other segments such as dry bulk in particular, having a scrubber allows for a healthier earnings level than the current market dictates."

Clarksons Research said earlier on Monday that the number of vessels undergoing scrubber retrofits peaked at 1.8% of fleet capacity in December, with higher levels for larger ships.

At the beginning of the year, the premium for LSFO over HSFO was about $307 per tonne.

Cleaves Securities calculated that owners of modern VLCCs could make the cost back in five months at that stage.

Bunkers prices hit a four-year low on 11 March, with a spread of $82 at that time.

As the HSFO price historically falls by less than low-sulphur fuels when the crude price drops, Banchero Costa’s research head, Ralph Leszczynski, predicted earlier this month that the premium will shrink further.

“The spread [between high and low-sulphur fuel] was already going down due to better availability from refiners of low-sulphur fuels, and will now see even more negative pressure from the fall in crude prices,” he said. “This is not good news for the economics of scrubbers.

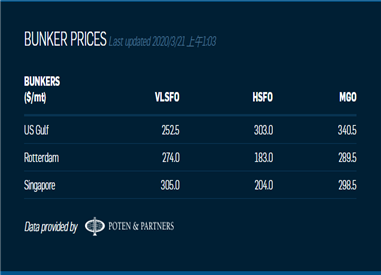

Today's Bunker Prices: