Carriers may have hit peak capacity reductions on main trades

Container lines have been blanking large numbers of sailings to cater to reduced demand. But new figures show the worst of the cutbacks may now be passing

THE volume of capacity withdrawn from container lines’ capacity may be about to peak, according to analysis.

Recorded blanked sailings as a result of the coronavirus pandemic now stand at 456, of which 342 were on the main deepsea trade lanes.

“For the Asia-Europe and transpacific trades alone, the amount of removed weekly carrying capacity increased from 3.1m teu last week, to 3.4m teu this week,” Sea-Intelligence said. “Compared with the typical downturn during Chinese New Year, this implies a potential global loss of volume of 7.4m teu in 2020.”

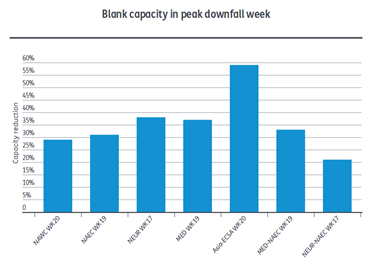

As the pandemic has progressed, blanked sailings have increased at different rates on different routes and have had a wider impact than just the main east-west trades.

The Asia-South America east coast trades had even more capacity removed than on services ex-Asia to Europe or North America, with capacity reductions of almost 60% forecast for week 20.

“Given that this particular trade is also heavily reliant on reefer exports from South America, the substantial amount of blank sailings happening in these weeks is likely to cause significant problems in relation to the export capacity for reefer cargo, four to eight weeks into the future,” Sea-Intelligence said.

On the transatlantic trade, capacity reductions were staggered, with Mediterranean capacity falling sooner than that on northern Europe routes.

“The difference in timing is clearly caused by the nature of the pandemic spread, which impacted the Mediterranean countries a little earlier than the North European countries,” Sea-Intelligence said. “We also see that the amount of blank sailings declines again earlier in the Mediterranean than for North Europe.

“However, if we look at the development of the pandemic, we are seeing more of a gradual re-opening in some of the northern European countries, whereas some of the southern European countries are still struggling, despite the infection data clearly declining. This indicates that we might expect more blank sailings to be announced for the South Atlantic trade coming out of the Mediterranean.”

But by viewing a rolling three-week average of announced blanked sailings, Sea-Intelligence noted that week 17 appeared to be the “peak impact” for the Asia-northern Europe and northern Europe-US east coast trades.

Other trades are expected to reach peak capacity removal in weeks 19 and 20.

Analysts at Platts also suggested that some container demand could start to re-emerge now that pandemic containment measures were starting o be eased.

“With some lockdown restrictions starting to lift, especially across much of Europe, there is hope in the market that there could be a boost in container freight demand, but this is likely to be a short-term rather than a more comprehensive outlook, as many importers and retail outlets are wary of a potential second-string of lockdown measures should coronavirus case numbers start to see more increases,” Platts said.