Singapore bunker industry thrives on regulatory controls

Efforts directed at maintaining a now decades-long bunkering licensing scheme and rolling out a mass-flow meter bunkering regime have paid off. Singapore has smashed its own record in 2017 and is luring bunker volumes away from smaller ports

THE unconventional approach Singapore has taken to develop its marine fuel sector is a blueprint now being widely cited to back calls for regulating bunkering operations at ports worldwide.

Singapore took the lead way back in the 1990s to license its bunker players. Three years ago, it rolled out the mass-flow meter mandate, making the use of metered pipes to measure bunkers transferred from seller to buyer compulsory.

This helps minimise the human intervention otherwise required in the conventional sounding method still used at most other ports in the world.

Contrary to popular expectations, from the outset, Singapore’s moves to tighten regulatory control over its bunkering operations has helped, rather than hurt its international standing in a notoriously opaque industry.

It went on to smash its own record by posting more than 50m tonnes of marine fuel sales during the first full year that its MFM mandate entered into force. Some observers have since cited Singapore’s trajectory as evidence to support to a push for regulatory oversight in the bunkering industry.

At an annual dinner in February, the International Bunker Industry Association’s incoming chairman, Henrik Zederkof, spelt out this goal — uniting the 10 most important bunker areas under a licensing scheme and adopting the use of mass-flow meters.

In northern Europe, ports in the Amsterdam-Rotterdam-Antwerp region have already made their intention clear to launch a licensing scheme, making MFM bunkering mandatory as soon as possible.

IBIA, which has been roped in for the initiative driven by Rotterdam, held that these moves would benefit the ARA region just as they have improved confidence in lifting bunkers in Singapore.

The months following Singapore’s MFM have seen premium market pricing on marine fuel oil products traded there over deals done in Rotterdam and elsewhere.

Significant lead

Singapore has held firmly onto its significant lead, even through the most disruptive transition imposed on the broader maritime sector.

Since the International Maritime Organization’s 0.5% sulphur limit on marine fuels came into force on January 1, international shipping has been forced to switch to new, varied and more costly marine fuels. Singapore posted 4.5m tonnes of bunker sales during the first month of this mandatory transition, up 7% over January 2019.

Trading sources noted that shipowners have shunned other ports in Asia regarding concerns about fuel availability, electing to refuel their ships in Singapore, where fuel options are said to be more readily available.

Shipowners have also drawn comfort from the presence of regulatory control over not just the quantity, but also the quality of bunkers delivered in Singapore.

This seems to be the vantage point for four influential industry bodies — namely the International Chamber of Shipping, BIMCO, Intertanko and the World Shipping Council — who took their tabled motion to the International Maritime Organization last December.

The tabled motion called on all IMO member states to follow Singapore’s lead in implementing and enforcing the licensing of bunker suppliers operating under their jurisdictions.

It argued that in so doing, member states can then help mitigate the safety risks posed by poor quality fuel oil entering the bunkering stream after the implementation of the IMO 2020 rules. The motion came just weeks after Singapore’s overarching maritime regulator further tightened its bunkering licensing scheme.

The Maritime and Port Authority of Singapore outlined, among others, one new prerequisite: suppliers are required to operate bunker tankers as well to qualify for new licences.

Industry veteran Simon Neo explained that what this prerequisite suggests is that only suppliers able to demonstrate control over the supply chain can qualify for bunkering licences with the MPA in the future.

These would come from holding positions — on both cargo and storage fronts — as well as owning and operating bunker tankers.

Henceforth, bunker suppliers licensed with the MPA after the new rules were spelt out would be fully accountable for the quality and quantity of bunkers they supply in Singapore.

To be clear, however, Singapore’s updated bunkering licensing rules have already gone beyond addressing the more immediate operational issues linked to the bunkering of conventional fuels. The new rules also call on applicants to pledge investment towards owning and operating dual-fuelled bunker tankers.

These go towards promoting the use of cleaner and greener fuels to power Singapore’s bunkering fleet, aligning with the IMO 2020 regulation, the MPA said when prompted about the regulatory update.

One MPA-licensed bunker supplier saw this coming. In September 2019, Sinanju Tankers announced the launch of its first liquefied natural gas dual-fuel bunker tanker.

Singapore’s proactive move to embrace LNG as a marine fuel would have also backed Sinanju’s calculated bet with its newbuild investment.

The MPA has issued the first pair of LNG bunkering licences and dished out co-funding or incentives to help defray upfront construction costs on bunker tankers and LNG-fuelled vessels.

Singapore now lays claim to completing the first commercial ship-to-ship bunker transfer, which took place at its sole LNG terminal during the first half of 2019.

Notwithstanding the traction that LNG bunkering has gained in Singapore and elsewhere, investments in LNG-fuelled vessels have yet to take off significantly. Only a few hundred of such vessels are on order and in operation.

Industry sources consider such a lukewarm response from shipowners as telling of the limited influence any regulator may wield over the uptake of alternative fuels.

Early movers in containers

That said, Lloyd’s List understands early-movers on this future fuel option in the container shipping space — CMA CGM, Eastern Pacific Shipping and Hapag-Lloyd — now consider Singapore favourably as the bunkering port of call for their LNG-fuelled vessels.

The MPA has nonetheless expanded the remit of its Green Ship Programme, which seeks to reduce the environmental footprint of the shipping industry. The programme provides a 50% reduction on an initial registration fee and 20% on the annual tonnage tax for qualifying ships registered under the Singapore flag.

These benefits previously applied to LNG-fuelled tonnage and are now extended to those ships equipped or to be equipped to run on alternative fuels with a conversion factor equal to or lower than LNG. Methanol and ethanol are two fuel options meeting the now updated criterion of the MPA’s Green Ship Programme.

The revised Green Ship Programme no longer covers ships installed with exhaust gas scrubbers approved by the MPA.

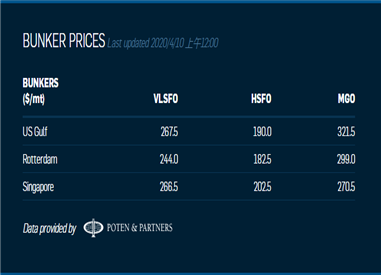

Today's Bunker Prices: