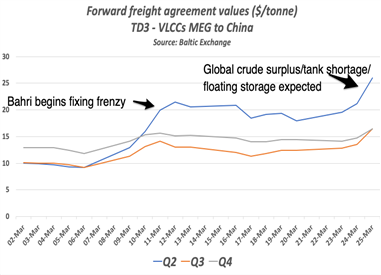

NEW signals have emerged that oil traders anticipate shore-based crude storage to quickly fill up as the value of tanker forward freight agreement contracts for the next six months soared 22% overnight.

The spike in freight futures provides further insight into market sentiment as the scope of the oil demand collapse and the scale of a looming crude and products surplus begins to emerge. The spike suggests traders and oil companies expect floating storage to surge in coming weeks, pushing up rates for tankers even as global demand for crude falls.

The second-quarter contract for very large crude carriers shipping 280,000 tonnes from Saudi Arabia to China — the most frequently traded FFA — closed at $25.99 per tonne on March 25, according to the Baltic Exchange. The contract gained 24% from the prior day and is 260% higher than its value at the beginning of the month.

The third-quarter FFA contract on the same route is now at $16.42 per tonne, up from $13.56 on March 24. The less-liquid second-quarter FFA contract for suezmax tankers showed a smaller gain of 11% on the previous day.

The coronavirus-led collapse in crude demand now overshadows the oil price war that sparked a tanker rates rally in mid-March. Saudi Arabia led a VLCC chartering spree after a pledge to flood the market with oil and maintain market share, seeing VLCC rates briefly set records before falling as quickly as they rose.

Russel Hardy, chief executive of oil trader Vitol, estimated lost crude demand to peak at 15m-20m barrels per day over the next few weeks, averaging out to 5m bpd for 2020. The 20m barrels lost over the last month amounted to about 600m barrels in surplus, Mr Hardy said, with some 300m-400m barrels of shoreside capacity remaining for refined products. Paris-based analytics provider Kpler estimated total global storage capacity at 71% with 1.8bn barrels of space available.

“There’s a lot of oil in the market and there’s a lot of stocks we’re going to have to build because oil isn’t going to be consumed,” Mr Hardy told Bloomberg TV. “Product inventories are building in North America, the US, Europe and India and refineries are going to have to cut runs.”

The coronavirus shutdown has paralysed land and air transport, which comprises 55% of the 100m bpd of crude consumed globally. India’s 21-day lockdown will further curb oil demand, with some 4.6m bpd imported in 2019, Lloyd’s List Intelligence data show.

Global refinery runs are already down by 7m bpd, Mr Hardy estimated, and another 7m bpd will be cut, as further reductions are needed.

Crude storage is going to “fill up pretty quickly” he added, with a greater shortage of land-based facilities for refined products. Once the wall was hit “producers have to make a decision about whether or not they want to keep pushing oil in to the market place,” he said.

Refineries worldwide from India, the UK, France and the US have announced cuts in throughput while Chevron, Total, Shell and Equinor are among oil companies announcing capex cuts this week.

Permian shale producers that export via the US Gulf are hit hardest by the oil price slide, which has slashed prices for West Texas Intermediate crude to $23 per barrel, well below the accepted $50 per barrel figure needed for profitability.

Today's Bunker Prices: