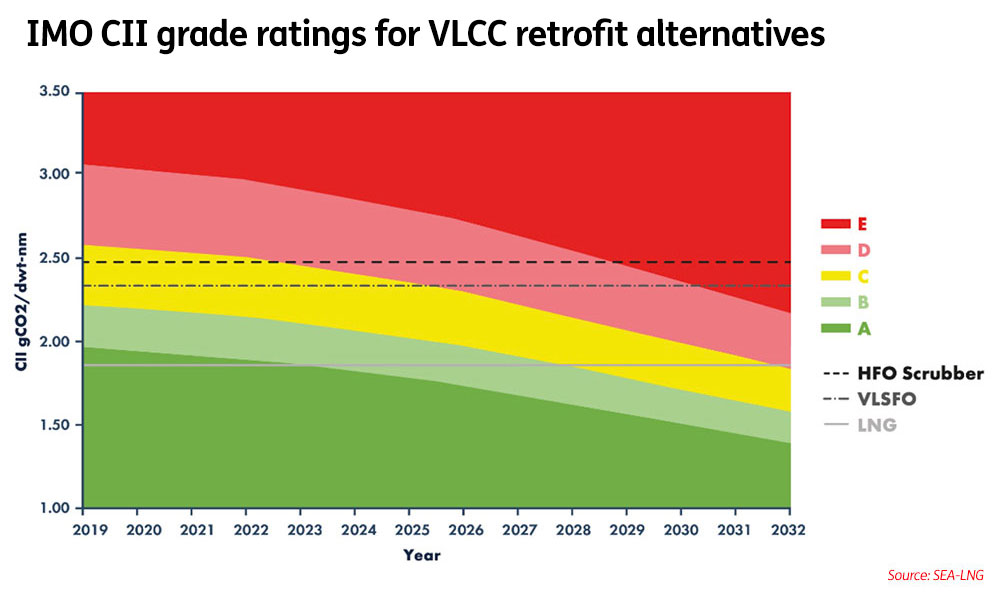

LNG-fuelled very large crude carrier retains a B grading until mid-2027 and C grading until 2032, according to SEA-LNG

SEA-LNG study claims $30.3m retrofit cost to use liquefied natural gas as marine fuel is ‘win-win’ for environment

LNG-FUELLED ENGINES ARE SAID TO REDUCE CARBON DIOXIDE EMISSIONS BY AS MUCH AS 23%, ALTHOUGH SAVINGS DEPEND ON ENGINE TYPE.

RETROFITTING a tanker to operate on LNG will give it a higher environmental rating under incoming global regulations that measure vessels’ carbon intensity, according to a study.

Research by SEA-LNG, which represents liquefied natural gas interests, found “significant benefits to a business choosing an LNG retrofit compared with fuelling with very low sulphur fuel oil or high-sulphur fuel oil with scrubbers”.

The study was based around a 10-year payback period and examined the Carbon Intensity Indicator of a very large crude carrier traversing the Middle East Gulf-China route, the world’s largest, according to SEA-LNG.

“This analysis concludes that retrofitting LNG as a marine fuel potentially delivers strong investment returns over the remaining 10-year trading life of the VLCC, with returns dependent upon the relative fuel prices of LNG, HFO and VLSFO,” the group said of the study’s key findings.

LNG is being positioned as a transition fuel to meet shipping’s decarbonisation targets, which include a 40% reduction in carbon dioxide by 2030 and halving of all greenhouse gas emissions by 2050.

However, environmental lobby groups have criticised the use of the fossil fuel as an alternative even as zero-carbon replacements are not available at scale.

The study said the cost of retrofitting a VLCC to use a two-stroke LNG engine and 4,600 cu m tank was $30.3m.

SEA-LNG said some of the global fleet of around 860 VLCCs risked becoming “stranded assets” under the new Carbon Intensity Indicator metrics, which rate ships from A to E and will be introduced under International Maritime Organization rules on January 1 next year. First rankings will be reported in March 2024.

Some 22% of VLCCs, or 157 ships, will be rated D, and a further 10% will be assigned a E grading, based on an assessment published earlier this week by shipbroker Braemar, based on an assessment of conventional fuels.

An LNG-fuelled vessel retains a B grading until mid-2027 and C grading until 2032, according to SEA-LNG. Other scenarios included using 0.1% fuel oil and 3.5% fuel oil with scrubbers.

“Compliant VLSFO falls from C to D in the year 2025 and into E in the year 2030,” the study said. “The HFO scrubber faces imminent danger of becoming obsolete due to the environmental regulations with an existing CII grade of C sliding into D in 2023. Stranding for the VLSFO-compliant vessel is delayed by two years with a drop from C to D grade in 2025.”

Under the CII, vessels with a D grading for three consecutive years or an E grading for one year must submit a corrective plan, but that is not followed up.

The study measured consumption at a speed of 13 knots but did not address the slow-steaming implications for the fleet under the different fuel scenarios of LNG, HFO with scrubber, or using VLSFO.

The CII, which aims to cut carbon output by 2% until 2026, measures how efficiently vessels transport goods in grams per carbon dioxide per cargo-carrying capacity and nautical miles.

LNG-fuelled engines are said to reduce carbon dioxide emissions by as much as 23%, although savings depend on engine type and findings are disputed.

“Retrofitting the VLCC fleet will be a win-win for the environment and the shipping industry,” the study said.

The initial study was undertaken by Opsiana, and is the third vessel type examined with previous studies looking at a 14,000 teu containership and 8,000 ceu pure car and truck carrier

Using LNG saw savings measured on a “net present value” basis of $6.1m to $15.1m across the different scenarios for a VLCC using VLSFO, according to the prior study.

LNG fuel delivered less value compared to a ship equipped with scrubbers and using 3.5% fuel oil in the “business as usual” case with “negative savings” of $6.4m and $12.7m.

However, the study was undertaken in 2019 with conclusions based on LNG priced at a $7.92 per million British thermal units. Prices in Asia and Europe are nearly four or five times this value, although the model assumes bunkering in Fujairah.

A later appendix to the case study, which is separate from the report, shows that LNG priced above $1,000 per tonne was not a better bet than VLSFO at $1,312 per tonne or less.

The high cost of LNG bunkers is seeing owners that already have dual-fuel vessels opting for conventional marine fuel at nearly half the cost as the Russia-Ukraine energy crisis drives prices higher.