Dynagas LNG Partners sees China demand returning, but hits brake on growth

Dynagas LNG Partners sees China demand returning, but hits brake on growth

US-listed company now set on auto-pilot for a couple years, as fully-employed fleet generates debt-cutting cash, earned in long-term charters

Gas carrier owner Dynagas LNG Partners will focus on debt reduction over the next couple of years, helped by cash from its fully employed fleet.

Any consideration to expand the fleet during that period has been put on the back burner, chief financial officer Michael Gregos told analysts in a conference call to discuss the company's fourth quarter financial earnings.

“Balance sheet protection is our top priority and growth initiatives have been put on hold for the moment,” Gregos said in the call.

Asked by an analyst when Dynagas LNG Partners would eventually use some of its cash towards acquiring new assets, Gregos said: “As our leverage goes down it makes it easier to discuss other things… the trajectory of our debt and the way it amortizes means in a couple of years we will be at a level which will make us feel more comfortable in general”.

George Procopiou-controlled Dynagas LNG Partners completed a major refinancing operation last year, which Gregos expects to save an annual $15m in interest expenses.

On top of that, the company carries an annual amortization burden of $48m through to 2023, followed a $471m balloon payment in 2024.

Fortunately for the company, it is not exposed to current lackluster freight rates in the spot LNG market. Dynagas LNG Partners' six ships are safely employed in long-term charters, most in the lucrative Yamal and Sakhalin projects in Russia.

The company sits on a $1.24bn contract backlog. Its fleet is fully employed through to the middle of 2021. They will continue to be so for years to come if Equinor decides next year to exercise an option to extend the employment of the 155,00-cbm Arctic Aurora (built 2013).

Markets may improve well before that, even in the spot market, as the coronavirus pandemic retreats in China.

“We’re starting to see the emergence of demand of spot shipping again, people are coming back to their desks in China,” said Tony Lauritzen, Dynagas LNG Partners’ chief executive.

“We expect the demand to increase going forward for them to facilitate their industrial production,” he added.

Such prospects help the company dispel any notion of going back private again - despite an equities slump that saw Dynagas LNG Partners' market capitalization shrink to a little more than $40m as of 13 March.

Asked whether Procopiou-led Dynagas Holding, which controls 44% of the company, might take it back private, Gregos said: “Our focus right now is just to deleverage and to improve our liquidity – that’s where our focus is at the moment, not taking the company private”.

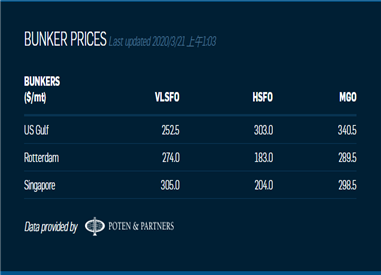

Today's Bunker Prices: