Genco to sell 10 more handysizes as part of fleet renewal plan

Genco to sell 10 more handysizes as part of fleet renewal plan

Company expects up to $85m in impairment costs during the first quarter

Genco Shipping & Trading has nearly doubled the scope of its multiyear fleet renewal plan by putting 10 additional handysize ships up for sale.

The John Wobensmith-led bulker owner has been in the process of offloading 15 older ships with the goal of lowering the fleet's age profile.

The company announced plans Tuesday to sell the additional handysizes as part of its fourth-quarter earnings report.

"In addition to the 15 original vessels designated to be sold under this plan, the company has determined to pursue the sale of 10 handysize vessels that were not already part of the plan and are viewed as non-core vessels within our fleet," Genco said.

"This is consistent with our focus on implementing our barbell approach towards fleet composition primarily weighted towards capesize and ultramax/supramax vessels."

The New York-listed company expects vessel impairment charges from $79m to $85m during the present first quarter, in addition to other potential impairments.

"If and when we sell each of these vessels, we will determine how to deploy the net proceeds, which may include repayment of debt and the purchase of modern, high specification vessels that complement our commercial strategy," the company said.

Genco's latest ship sale is Wednesday's delivery of 28,400-dwt Genco Charger (built 2005) to undisclosed buyers.

Other ships sold in the quarter include 28,400-dwt Genco Challenger (built 2003), 28,400-dwt Genco Champion (built 2006) and 76,500-dwt Genco Raptor (built 2007).

The company also plans to offload 76,600-dwt Genco Thunder (built 2007) for delivery in the first quarter.

Profit falls amid higher costs, impairment charges

New York-based Genco posted a $0.88m profit for the fourth quarter, down from an $18.3m profit during the same period last year. Revenue also fell to $109m from $112m.

Earnings per share came in $0.02, missing analyst consensus by $0.06.

“We are currently experiencing a short-term, seasonal decline in overall dry bulk freight rates, which has been further impacted by the onset of the Covid-19 novel coronavirus," chief executive Wobensmith said.

"In anticipation of the seasonal freight rate pullback in the first quarter, we have fixed vessel revenues for a portion of the quarter, providing Genco with a degree of insulation from current market conditions."

The company still posted a $0.175 dividend for the quarter as part of its dividend policy begun in the second quarter that has so far awarded $0.675 in total dividends to shareholders.

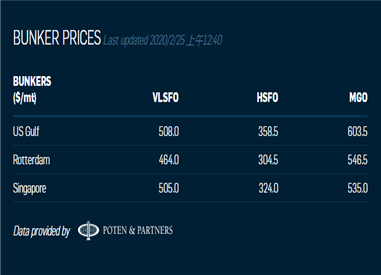

Today's Bunker Prices: