EPS turns to DSME to raise dual-fuelled boxship tally

EPS turns to DSME to raise dual-fuelled boxship tally

Neo-panamax sextet takes total number of LNG-fuelled vessels ordered to 23

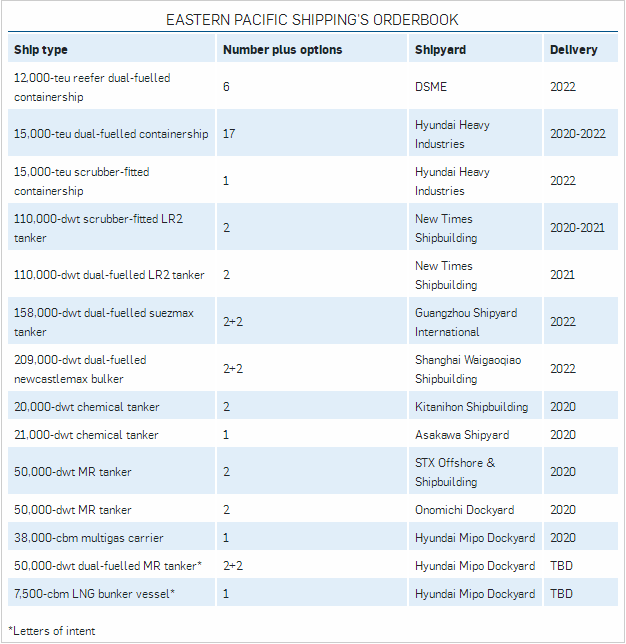

Eastern Pacific Shipping has increased its order tally for dual-fuelled containership newbuildings.

The Idan Ofer-led company has splashed out about $771m on LNG-powered neo-panamaxes in its latest booking spree.

Shipbuilding players familiar with Singapore-based Eastern Pacific said it is behind an order for six dual-fuelled boxships disclosed by South Korea’s DSME last week.

The deal follows orders at Hyundai Heavy Industries for 17 LNG-fuelled 15,000-teu vessels, taking its total haul of LNG-fuelled containerships to 23.

Of the DSME sextet, one shipping source said: “These are 12,000-teu and not 15,000-teu vessels. They are high-reefer LNG dual-fuelled ships.”

“Eastern Pacific has ordered them against specific charter requirements.”

The identity of the charterer has not been disclosed, but some boxship players suggest the client is Aponte family-led Mediterranean Shipping Co.

Officials at DSME and Eastern Pacific declined to comment, citing contract confidentiality.

Eastern Pacific was reported to be paying about $128.5m for each vessel and is slated to take delivery of them in the second and third quarters of 2022.

HHI order

The 17 ships at HHI were ordered last year and in 2018 for between $130m and $135m each.

They are slated for delivery from this year to early 2022, and industry sources said Eastern Pacific has chartered six of them to French liner giant CMA CGM for 15 years at $55,000 per day.

Eastern Pacific believes LNG will be shipping's fuel of the future, and is prepared to pay extra for dual-fuelled large tankers and bulkers.

“Eastern Pacific strongly believes that, as a shipowner, it needs to make a concrete commitment to the environment and reduce the carbon footprint,” a source familiar with the company said. “One can easily see the fuel economics works versus a conventional vessel.”

The company is also due to take delivery of the scrubber-fitted, 15,000-teu CMA CGM Brazil from HHI in April. The ship is part of a five-boxship deal booked at the Ulsan-based yard in 2017.

CMA CGM has chartered the quintet for 10 years, paying $40,000 per day for each vessel. HHI delivered four of the newbuildings — the CMA CGM Argentina, CMA CGM Mexico, CMA CGM Panama and CMA CGM Chile — last year.

Eastern Pacific has been active booking newbuildings for the past few years, investing more than $4bn.

Orders included crude carriers, product and chemical tankers, and gas carriers.

The newbuildings are part of the Eastern Pacific's fleet expansion and renewal.