If the world is going towards ammonia, we will have the first carbon-neutral vessels in our segment. If not, we will have some very efficient vessels that happen to be a couple of million dollars more expensive. Either way, we win, says Höegh Autolin

Looking ahead, methanol and biofuel will be more expensive and shipping will be competing directly with the aviation sector’s bigger pockets. This makes ammonia the most realistic deepsea fuel choice that the industry can take today if it wants to future-proof orders, argues Höegh Autoliners

HÖEGH AUTOLINERS SAID ITS AMMONIA-READY CAR CARRIERS ARE SCHEDULED TO BE DELIVERED FROM THE SECOND HALF OF 2024.

THE car carrier sector’s collective ordering spree, currently hovering around the $4bn-$6bn mark, has almost exclusively focused on liquefied natural gas-dual fuel orders under pressure from car manufacturers looking to ensure eco-credentials in their chartering policy.

The standout exception in the race to secure fleet replacement yard slots delivering from 2024 has been Höegh Autoliners, which earlier this month announced its intention to outspend its rivals with a series of ammonia-ready 9,100 ceu giants.

Should the series of 12, including options, be confirmed beyond the letter of intent signed with China Merchants Heavy Industry, these aurora class vessels will be the largest, and arguably most efficient pure car and truck carriers, known as PCTCs, on the water.

Paying a premium now for ammonia-ready tonnage is less a punt on the industry’s decarbonisation transition and more a pragmatic decision to satisfy some of the industry’s most demanding customers, the auto industry, according to Höegh Autoliners chief executive Andreas Enger.

“Our clients are the least patient when it comes to the energy transition because they have global brands that are rapidly having to implement an energy transition in their own systems via the electrification of cars and their production,” he said. “And deepsea transportation is moving from being an insignificant issue to a substantial part of the carbon footprint of what they’re delivering.”

The price tag negotiated with China Merchants for the ammonia-ready design has not been revealed, but Mr Enger concedes that a small premium of around a couple of million dollars is being paid in excess of the anticipated cost of a similarly Chinese-built 7,500ceu dual-fuel LNG spec.

The recent flurry of orders for 7,500ceu dual-fuel designs have commanded between $87-$90m. Brokers have estimated that 9,100ceu version of those designs would likely cost in the region of $98-$100m.

While the aurora-class plans have been waiting on paper since before the coronavirus backdrop decimated PCTC demand, forcing much of the fleet to idle in the past year, Höegh is relatively late to the ordering spree that has seen most of its rivals and the major tonnage providers order LNG-dual fuel slots for earlier delivery.

Rapid steel price inflation, combined with a supply vacuum, have led to skyrocketing newbuilding prices following a barren period of low orders stretching back to 2016.

By building a larger 9,100 ceu design, Höegh says the improved carbon footprint and cargo flexibility will more than offset the premium in the long run, regardless of how quickly availability of carbon-neutral ammonia infrastructure and fuel availability emerges.

“We are not building vessels to extract the current charter market, but rather building vessels operate for 25 or 30 years,” said Mr Enger, adding that the ammonia option was realistically the only sensible one that they could take right now.

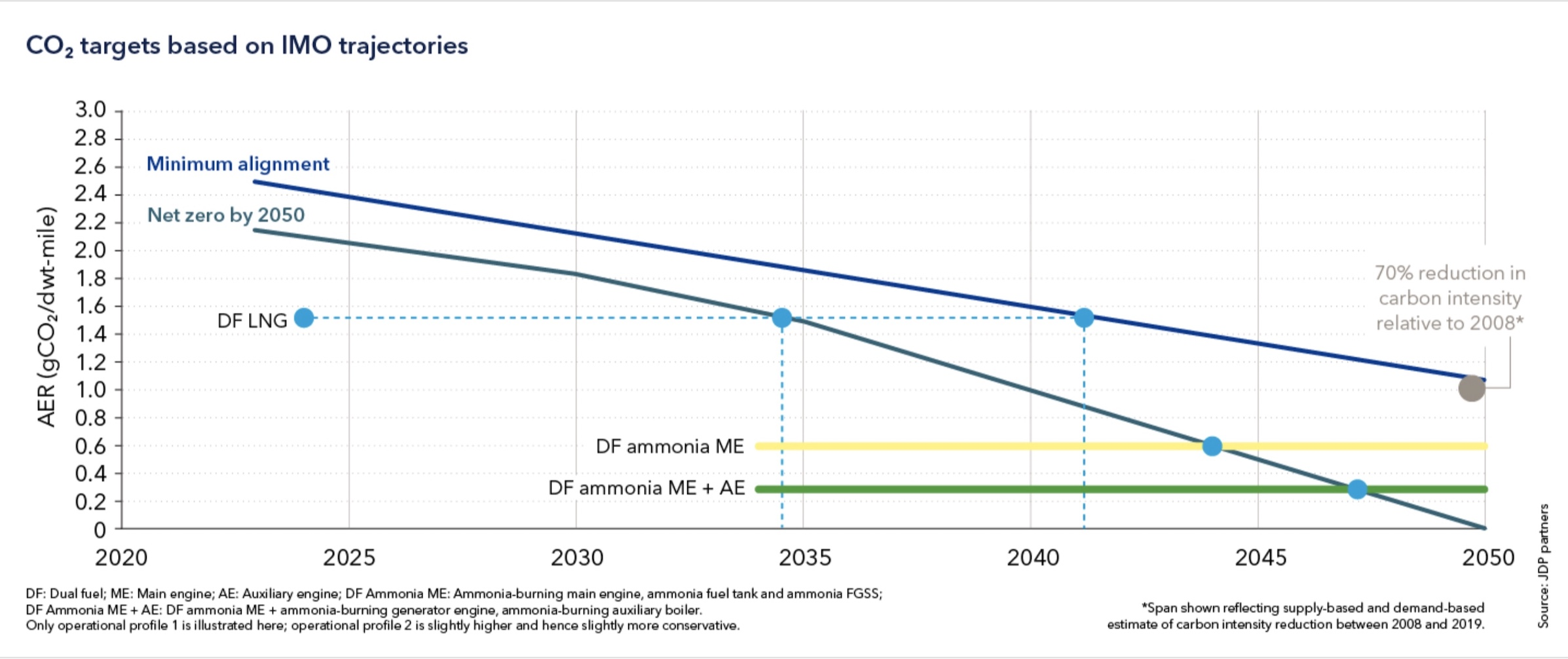

While the aurora vessels will initially operate on LNG along with the rest of their rivals, once ammonia availability and pricing allows, the switch will put Höegh well ahead of the market, he said.

“We are the only ones in the sector building vessels that can run on ammonia. Right now, they will be able to operate on biofuels and LNG, but we believe that ammonia now seems to be the most realistic deepsea fuel of the future.

“Methanol and biofuel will likely be more expensive and we’re going to be competing directly with the aviation sector, which arguably has a high willingness to pay.

“I also think that the commitment to the hydrogen economy we are seeing now from governments is quite strong and ammonia is the hydrogen derivative that is going to be most useful for deepsea shipping.”

On the technical side, Höegh’s engineers also gravitated towards ammonia as the future fuel of choice on the basis that engine conversion is relatively simple. The vessel conversion is less easy if you are starting from a conventional design.

Because of the toxicity of ammonia, gas barriers around the engine room and the fuel handling areas are required and separation of ventilation shafts must be built in to be able to safely evacuate gas.

“You need quite a number of things that are actually quite easy to build into a new design, but almost impossible to retrofit,” said Mr Enger. “I think our conclusion was that we were not making a huge bet on ammonia because we were actually building vessels that are cargo efficient in the short run and can run on anything.

“But we think not making it ammonia-ready and going for one of those conventional dual-fuel LNG designs is in our view a bet against ammonia.”

Paying a premium for future-proofed flexibility in a market where you intend to operate a vessel for the next three decades is a bet Mr Enger is willing to take.

“If the world is going towards ammonia, we will have the first carbon-neutral vessels in our segment. If the world is going against ammonia, we will have some very efficient vessels that happened to be a couple of million dollars more expensive. Either way, we win.”