THE market for liquefied natural gas carriers is set for a challenging few months as cargo cancellations have hit unprecedented levels and are expected to grow.

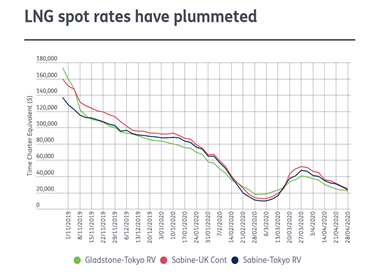

LNG spot rates have slid by 50% since the end of last month, reaching as little as $22,000 per day for Pacific voyages, according to the latest data from the Baltic Exchange. After a slight recovery during March, spot rates are on course to sink back to the historic lows recorded at the start of last month.

Rates have declined on the back of LNG cargo purchase cancellations for June, as low LNG prices and negative sentiment on demand are dissuading buyers from shipping LNG cargoes.

LNG buyers cancelled about 30 scheduled orders for June, Poten & Partners global head of business intelligence Jason Feer told Lloyd’s List. “We have never had this. This has never happened,” he said.

The combination of a demand shock from the coronavirus and the option of dropping US cargoes at a small cost have fuelled cargo cancellations.

The US was the third largest LNG exporter for 2019, with 33.8m tonnes and 10% of the market, according to the International Gas Union.

Apart from now being significant suppliers, US producers have differentiated themselves from international competitors by allowing customers to cancel or defer orders and pay only a limited part of the contract, rather than the price of the full order. Hence, the uptick in the June cargo cancellations.

Flex LNG chief executive Oystein Kalleklev said he expects the second quarter to be disappointing for LNG shipping companies.

“The prices of the gas have converged all over the world and we have seen massive cargo cancellations for June,” he told Lloyd’s List.

Apart from flooring oil prices, the coronavirus chokehold on global economic activity has also inflicted damage on LNG prices, which were already under pressure from the supply side.

The crucial Asian, US and European LNG price benchmarks are almost on the same level, undermining the case for shipping LNG. S&P Platts reported that JKM, the benchmark for LNG deliveries in northeast Asia, fell to a historic low of $1.90 per million British thermal unit this week.

Mr Kalleklev said that for LNG shipping to pick back up, the spread between JKM and especially the Henry Hub, the North American LNG benchmark, has to widen again, thus bolstering the business case for shipping cargoes across the Pacific.

The cargo cancellations have resulted in big portfolio players having ships available to re-let to the market, something that can be difficult to compete with, he noted.

Flex LNG has three LNG carriers on the spot market and three on time charters, with vessels of 173,400 cu m or 174,000 cu m capacity. It is also scheduled to take delivery of seven more vessels of the same capacities between the summer of 2020 and the second quarter of 2021.

“The problem we are seeing with low gas prices is that you will also have a lot of cargo cancellations in July,” Mr Kalleklev warned.

Mr Feer said that so far there have been about eight or nine cargo cancellations for July. More are expected to happen in May.

Most cargo buyers are cancelling orders two months ahead of time, he said. But some are scrapping orders three or four months in advance, all the way through to September.

That affords them the flexibility to consider their buying strategy and can give them a better shot at re-letting their vessels given the greater amount of time — and voyages — they could accommodate if that demand does come up.

Spot rates may be in freefall but the actual availability of vessels is low, a fact that under normal circumstances should be tipping the scale in favour of the owners.

Last week in the Atlantic, there was just one vessel available, Mr Feer said, down from three the week before. Asia and the Middle East listed as having two vessels available each.

Mr Feer explained that despite cancelling cargoes, and therefore theoretically freeing up tonnage, charterers are keeping their tonnage due to fears about coronavirus quarantine restrictions; they want access to ships in case they face issues with crew, demurrage problems and or if a vessels has to be quarantined for two weeks at port.

This results in what he called ghost tonnage; ships are not actually carrying cargoes but they are not being deployed in the market either.

With a slew of LNG newbuilds set to be delivered this year, the market will only tighten. Poten estimated at the end of last week that it expects 20 more LNG carriers to become available to the market over the next 30 days.

Better days ahead and even… floating storage?

The International Gas Union reported earlier this week that global LNG trade increased by 13% to 354.7m tonnes in 2019, an all-time high. But after six consecutive years of growth, LNG trade is unlikely to climb further.

Poten said in a recent note that, as of April, it anticipates overall LNG global demand to drop — from from its level of circa 360m tonnes in 2019 — by 8m tonnes in 2020. This represents a 10m tonne revision from its February forecast.

“Nearly every country in the world is expected to see an impact from the pandemic, but the largest impacts will be seen in Northeast Asia. Europe, too, is seeing an impact in demand, with power and industrial demand being hit particularly hard. Southeast Asia is also starting to see effects,” it said.

After being slow to respond to the market, LNG suppliers are also making curtailments, Mr Feer said. That could further help rebalance the market.

Qatar, the world’s largest LNG exporter with 77.8m tonnes in 2019, has already reduced output by four to five cargos per week, Mr Feer noted. Those are not necessarily cargo cancellations but rather represent reductions in productions or sales.

But deeper supply cuts will be required over the next few months.

Banchero Costa reported this week that LNG imports into the European market grew by 31.2% to hit 23.7m tonnes compared with the same period of 2019. Even during the first three weeks of April, with the majority of Europe under lockdown, LNG imports grew by 3.8% compared with the same period last year.

Much of this inflated demand is because cargoes are being stored, Mr Kalleklev observed, rather than actual demand for use. It follows the convergence of the different LNG price benchmarks, that are pushing cargoes from the US to Europe, instead of to Asia.

Indeed, US LNG exports to Europe grew by 178% year on year during the first quarter of 2020 to 7m tonnes, giving the North American nation 30% of the European Union market, Ranchero Costa added.

With Europe currently storing up LNG on land, Poten warned capacity will fill up some time between late July to early August.

US producers are expected make significant reductions to supply.

“For the remainder of the year, roughly 5.5m tonnes will have to be cut from locations outside the US. The largest surpluses will be seen between July and October before late autumn/winter demand starts up,” Poten added.

The situation bears resemblance to the situation in the tanker markets; an oversupply of crude oil and historically low prices have catapulted demand for tankers as floating storage as land space dries up.

Could the same happen in the LNG market?

“If you don’t know where you are going to put a cargo of LNG, the worst thing you can do is put it on a ship,” Mr Feer said.

Unlike crude oil, where the main concern with tanker storage is the charter cost, LNG carriers also have to deal with a boil-off rate, which is the share of the cargo that is lost during transit- or storage.

These rates can vary depending on the quality and age of the LNG carrier, but are thought to be on average around a 0.15% per day. Under a three month storage contract that would mean 13.5% of the cargo would be lost.

The daily charter cost, the boil off rate and the uncertainty that comes with simply holding cargo make LNG floating storage an unattractive proposal for companies, Mr Feer noted.

“I think for a lot of companies over the next three to five months the best of a bad option is going to be to cancel the cargo rather than to use floating storage,” he said.

Land storage capacity is a crucial driver for floating storage demand. But another is the expected future price of the cargo.

Mr Kalleklev believes that a contango market, where futures prices are lower than the spot price, could develop for LNG that would justify floating storage during the autumn of 2020.

LNG demand fluctuates seasonally and the hope is that despite the coronavirus shock demand will pick up again, prompted by the next winter season for the northern hemisphere.

Many LNG contracts are linked to the price of Brent crude oil, which stood at around $21.39 on Tuesday morning. A slope from today’s prices are applied to future contracts.

Mr Kalleklev said that with the usual 11%-13% slope on Brent applying to 70% of the LNG market, in six-months’ time LNG will be “extremely cheap”. That would beneficial timing ahead of the winter season, when demand should ramp up and prices grow.

Flex LNG will take delivery of two new LNG carriers in the second half of the year that offer a 0.035% boil off rate, an improvement compared with the rest of its fleet. A third such vessel, also delivered later this year, has been picked up by Guvnor for a long-term charter.

Mr Kalleklev said the company has not considered delivery delays yet for the two ships that are not yet employed, pointing out that they may be arriving on time for a better market.

Back in November, South Korea announced it would be shutting down a quarter of its coal-fired plants for the winter season due to pollution reasons. Mr Kalleklev questioned whether they should open up again.

“There is no benefit of actually opening those again. It is much better buying natural gas,” he said.

The low LNG price will also offer a competitive advantage over coal, whose prices have also plummeted.