CHAOS in the crude sector is spilling over into the clean markets as the shortage of land-based commercial storage for transport fuels ignites record-busting rates for product tankers, with earnings now above $150,000 daily for aframax-sized vessels.

Panicked chartering has set in since oil traded at negative levels this week as the scale of the crude oversupply emerged with traders seeking tankers for floating storage of jet fuel, diesel and gasoline.

The accelerating surplus of air and land transport fuels amid a lack of land-based storage is also leading to discharge delays at ports and increased volumes of distressed cargoes, compounding vessel availability on the spot market.

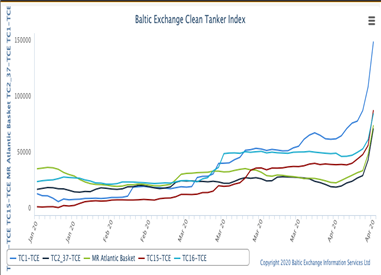

Rates for long range two tankers doubled in two days on benchmark routes, while medium-range tankers plying transatlantic trades are 186% higher than last week, at nearly $88,000 daily according to the Baltic Exchange.

At the same time prices for jet fuel, diesel and gasoline plunged to 20-year lows on April 21, leaving freight costs on some of the busiest routes comprising nearly a quarter of total delivered prices.

This generation of oil traders have never seen such off-the-scale volatility and bizarre costing assessments, Lloyd’s List was told.

Floating storage economics also indicate significant profits for jet fuel and gasoline fuels, based on information complied by Lloyd’s List, adding to skyrocketing demand for aframax and panamax product tankers.

The coronavirus pandemic-led lockdown has paralysed the global economy and wiped out a third of crude consumption totalling 100m barrels per day. Demand for jet fuel has contracted to a tenth of normal levels of about 5m bpd alone.

Profits for oil traders to buy jet fuel, take out a futures position, then store it on a VLCC and sell in six months exceeded $10.5m, based on northwest Europe prices and swaps from Argus Media.

Gasoline floating storage profits over six months on a LR2 tanker were calculated at about $5.4m. The spread between the current and future price exceeds $15 per barrel in northwest Europe.

Refiners are exporting as much product as possible because of tank shortages, while traders struggle to sell cargoes already on the water as prices collapse further every day. Widespread discharge delays have been reported on the east coast of Mexico, a key market for medium-range tankers shipping gasoline from US Gulf Coast refineries, because storage capacity had been reached.

Freight rates equate to a record-breaking $83.35 per tonne of the Baltic-northwest Europe route, according to the Baltic Exchange. That route from the Baltic ports, including Primorsk, supplies Germany, France, UK and other northern European countries with the majority of diesel imports.

Diesel is currently priced in the UK at just over $207 per tonne. Average freight costs are normally less than a tenth of the free on board price.

Medium-range tanker earnings to ship gasoline to New York from the Amsterdam-Rotterdam-Antwerp reached nearly $75,000 on April 23, according to the Baltic Exchange. That is the highest on record going back to June 2008.

Some 111 time charters for periods of up to 12 months have been reported for VLCCs, suezmax and aframax or long-range tankers and tracked by Lloyd’s List during the past four weeks. That includes 30 fixtures from the aframax fleet, which are normally used to store refined products, data shows.

All ten LR1 period charters tracked this month have options for storage for periods of 30 to 60 days, a further signal of distress in the clean products market.