SINGAPORE’S bunker sales jumped 5.7% on year last month on the back of increased cargo flows through its port as factories shut due to the coronavirus pandemic restarted operations in China.

The world’s busiest bunker hub posted 4.32m tonnes in marine fuel sales for March, up from 4.09m tonnes a year ago and 3.88m tonnes the previous month.

It handled more cargoes by tonnage terms. March throughput was 53.08m tonnes, up from 52.02m tonnes the same month last year and 47.63m tonnes in February.

For the first time in years, however, Singapore's monthly vessel arrivals slipped under 10,000.

March saw just 1,399 containerships visiting Singapore, down from 1,509 the year before.

This decline is partially offset by year-on-year increases seen in two commercial shipping categories — 1,446 bulk carriers and 2,417 tankers called at Singapore in March, up from 1,273 and 1,978 respectively.

Bunker industry veteran Simon Neo suggested that bunker inquiries have risen in the past month. China’s economy coming back to life again has helped to boost trade flowing through Singapore and other key ports.

Still, with key European countries remaining locked down, Asia-Europe trade has not fully normalised and this possibly contributed to a reduction in Singapore’s container vessel traffic, he added.

Others pointed to tankers being mobilised for floating storage worldwide and the transport of chemicals used in manufacturing of chemical products as the likely cause of an increase in Singapore’s tanker arrivals.

On the flip side, Singapore’s move to restrict crew changes in its bid to contain the coronavirus outbreak at home has not helped bunker sales at its port.

Lloyd’s List has learnt that the completion of certain sale and purchase transactions on vessels could not take place in Singapore because the crew could not board the ships involved.

In some cases, these ships ended up moving on from Singapore to refuel and carry out their crew rotations elsewhere, sources told Lloyd’s List.

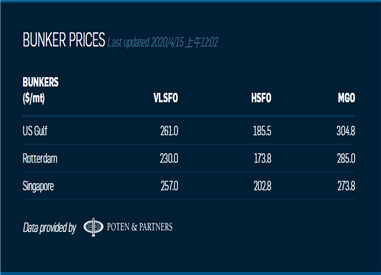

Today's Bunker Prices: