Tanker owners 'can name their price' in near-term bargaining after Saudi price cuts, analysts tell clients.

VLCC rates heading back above $200,000 per day?

Equity analysts from Clarksons Platou Securities suggested the possibility in a conference call this week with clients on the Saudi Arabia-Russia oil prices war now unfolding.

Their comments came before a reported fixture of 18 VLCCs on subjects by Saudi Arabia’s national shipping arm Bahri pushed spot rates close to $170,000 per day Wednesday.

The Saudi price cuts “are the most drastic we have seen,” said analysts Omar Nokta and Frode Morkedal, with the only comparable point Saudi Aramco’s $4 per barrel price cut to US buyers in November 2007.

“At the time VLCC rates were hovering around $35,000 per day but spiked to $125,000 per day over a 3-week span as buyers rushed to purchase cargoes and fix available ships,” the analysts said in a presentation.

“By late-December 2007 they had eventually surpassed $200,000 per day. A similar scenario could play out in today’s market. “

One major difference, the analysts note, is that the 2007 deal was offered to US buyers only, while today’s larger cuts have been offered to all buyers.

“We’re not necessarily saying VLCCs are heading to market of $200,000 a day, but it wouldn’t be a surprise if they do,” Nokta told clients.

“It’s not inconceivable to think we’re going to gap up in next days and weeks. The whole sector is positioned to do well, both crude and products. The market is in line for a very strong move upwards over the next days and weeks.”

If the move is that strong, it could top even rates seen last October, when reported record VLCC fixtures above $300,000 per day were later learned to have failed.

Brokers said then that the top confirmed fixtures likely landed somewhere between $150,000 and $200,000 per day – still a surprise boon to the market on factors including US sanctions.

The Clarksons analysts perhaps got a bit of their own surprise in the question-and-answer portion of their programme when a celebrity guest – Nordic American Tankers chief executive Herbjorn Hansson – quizzed them about the effects of the cuts on US shale oil production.

The impact could be substantial, Nokta answered. Unlike other production areas like deepwater Brazil or Saudi Arabia, shale production is fairly sensitive to the prevailing price of Brent or West Texas Intermediate (WTI) crude.

Moreover, fields with five-year production contracts tend to pump the most in the first 12 to 18 months, and are quite price-dependent thereafter.

“After that it requires a higher oil price,” Nokta said. “There’s a good amount of production at risk. At a minimum, 1m barrels could come off the market and be supplanted by the Saudis.”

A barrel price of $50 is the point at which shale production begins to lose ground, Nokta said.

Overall, “tanker owners are in a very good bargaining position — they can name their price in bargaining in the near term.”

At the same time, long-suffering public tanker stocks, which had been down 30% to 40% on the year, “are set up for a terrific run here,” Nokta said.

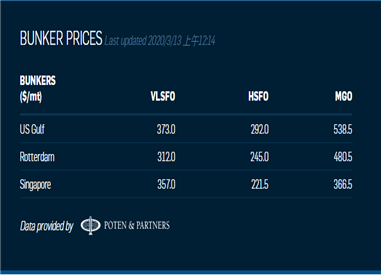

Today's Bunker Prices: